China's iron ore demand to drop significantly by 100 million tons? The tone for iron ore in 2022 has been set!

According to China Metallurgical News, in 2022, China's pig iron and crude steel production are likely to be around 800 million tons and 920 million tons respectively (pig iron production is closer to 2019, and crude steel production is closer to 2018). Pig iron production will continue to decline by 62 million tons, and crude steel production will decline by 100 million tons, with a decrease of 7.2% and 10% respectively. The corresponding iron ore demand will decrease by about 100 million tons.

Carbon peaking and carbon neutrality are important constraints faced by China's entire steel industry in the near and medium to long term. Under the background of low carbon and high-quality development, the current situation of high output and low efficiency in China's steel industry will lead to spontaneous production reduction and increased market supervision on ecological and environmental protection in the industry. If the downstream demand for steel weakens next year, China's crude steel production will most likely maintain the production reduction pace of the second half of this year.

Taking the development of Japan's steel industry as an example, after reaching its peak in 1973, Japan's crude steel production has generally adjusted in time according to changes in downstream steel demand, with a year-on-year increase or decrease of between plus and minus 10%. China's crude steel production has most likely peaked in 2020, and future crude steel production will be adjusted timely and dynamically according to the downstream demand for steel to maintain reasonable profits for the steel industry and achieve the key goal of high-quality steel manufacturing.

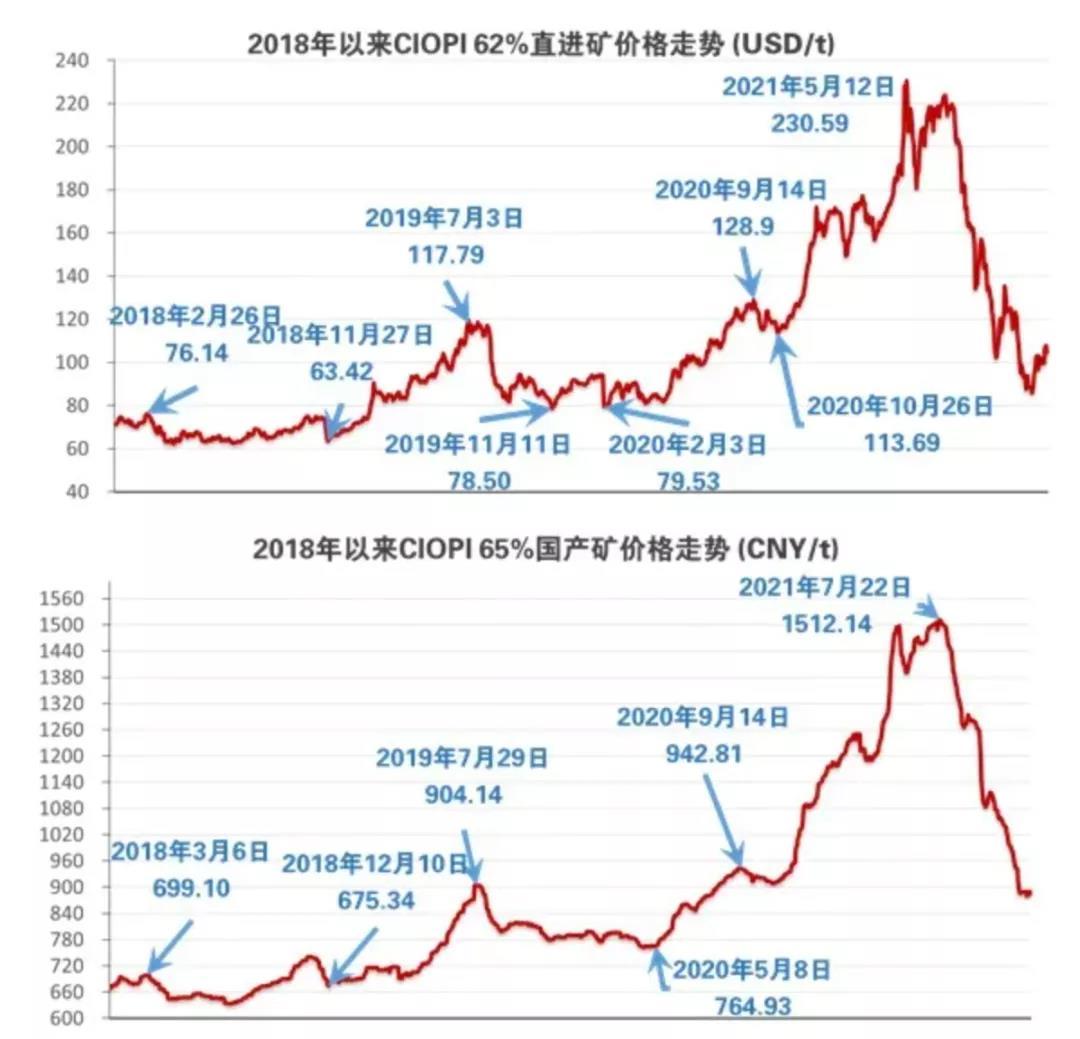

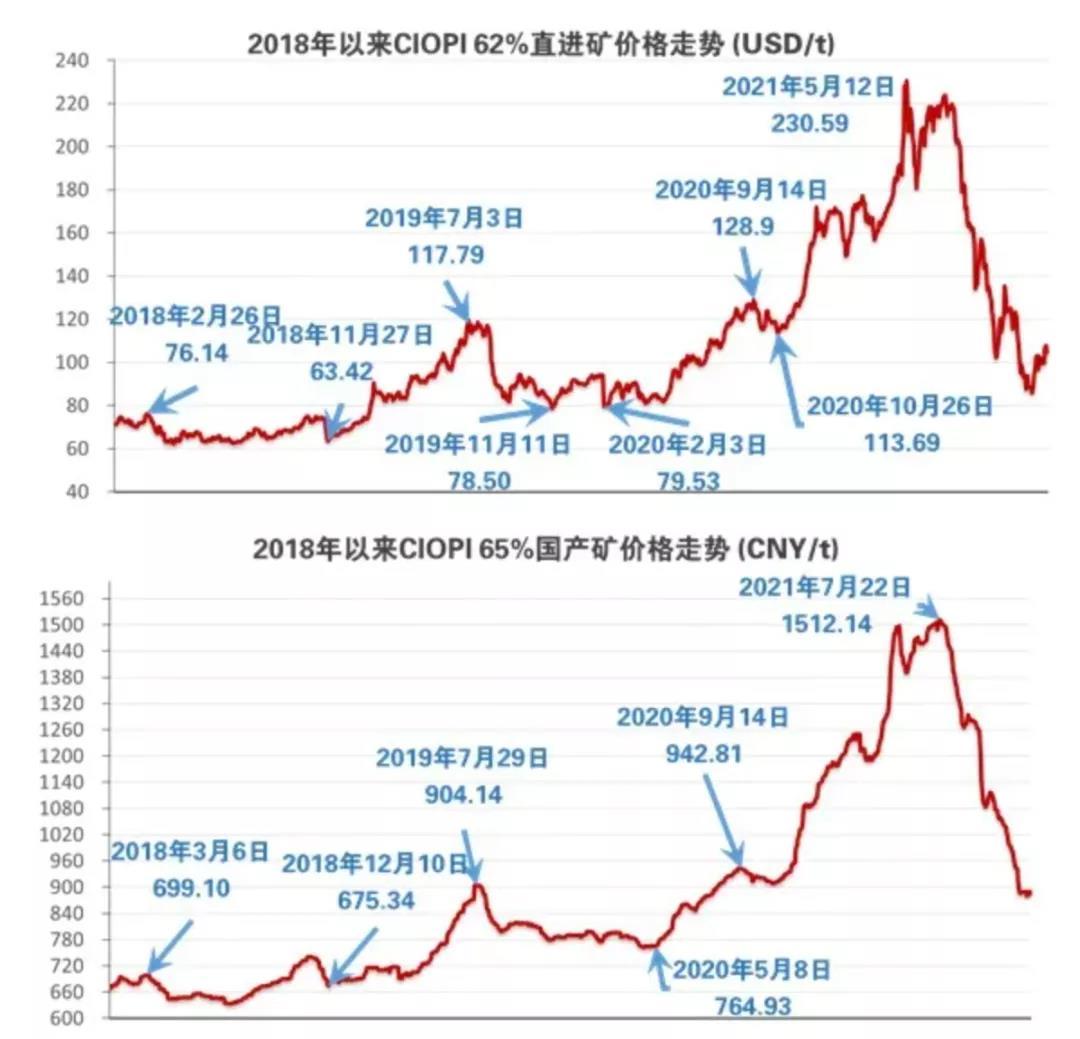

In terms of iron ore, in addition to the fact that demand is still likely to decline significantly, China's import ore port inventory, mining production rhythm, and operating and payment cost pressure are several key factors determining the bottoming out of iron ore prices next year.

Since June this year, with the decline in China's iron ore demand, the inventory of imported ore at ports has slowly rebounded and accelerated in October. According to Mysteel statistics, as of last Friday (December 10), the total inventory of iron ore at 45 ports in China was 154.8491 million tons, a week-on-week increase of 279,800 tons, and the average daily unloading volume was 2.7972 million tons. According to the current port inventory and unloading level, the current inventory can be used for 55 days, an increase of nearly 57% compared with the level of only 34 to 35 days in the middle of this year.

According to Mysteel's survey, as of (December 10), the operating rate of blast furnaces in 247 steel mills was 68.14%, a decrease of 1.66% compared with the previous period and a decrease of 16.63% year-on-year; the average daily pig iron production was 1.987 million tons, a decrease of 18,100 tons compared with the previous period and a decrease of 447,700 tons year-on-year, and demand has not yet significantly improved.

On the supply side, the mining production rhythm is still running at a high speed. From the production and sales situation of major overseas mines, except for Vale in Brazil, which is gradually making up for the production reduction caused by the dam collapse accident in 2019, the output of other mines remains at a high level.

Under the current basic supply and demand of iron ore, the supply and demand pattern of iron ore is still significantly loose. With the approach of the Winter Olympics and the continuous high pressure of environmental protection, the increase in pig iron production is limited, and the port inventory continues to accumulate. The market has clearly become fearful of the current ore price, and the iron ore price may maintain a wide range of fluctuations.

With the fluctuation of iron ore prices, there is also the issue of mining operating costs.

Currently, the C1 cash cost of iron ore from the four major mines is between $11.84 and $15.40 per ton. According to Mysteel data, the average production cost of iron concentrate in key domestic mines in 2020 was 367.54 yuan/ton (converted using the average exchange rate of 1 yuan = $0.1449 in 2020, which is equal to $54.54 per ton), almost four times the cost of the four major mines.

This year, affected by inflation, transportation, and ecological and environmental protection factors, domestic ore production not only lacks market competitiveness but also bears considerable operating and ecological and environmental protection pressure.

Domestic mines cannot break through on their own. It is necessary to speed up the integration of upstream and downstream resources and collaborative development with the help of reorganized groups such as Baowu Group and Ansteel Group.

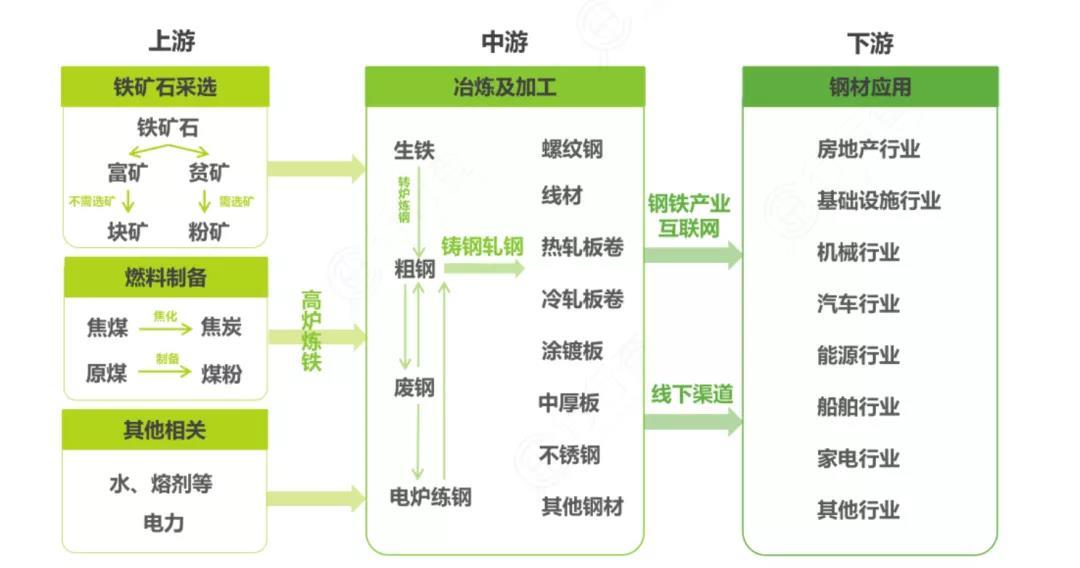

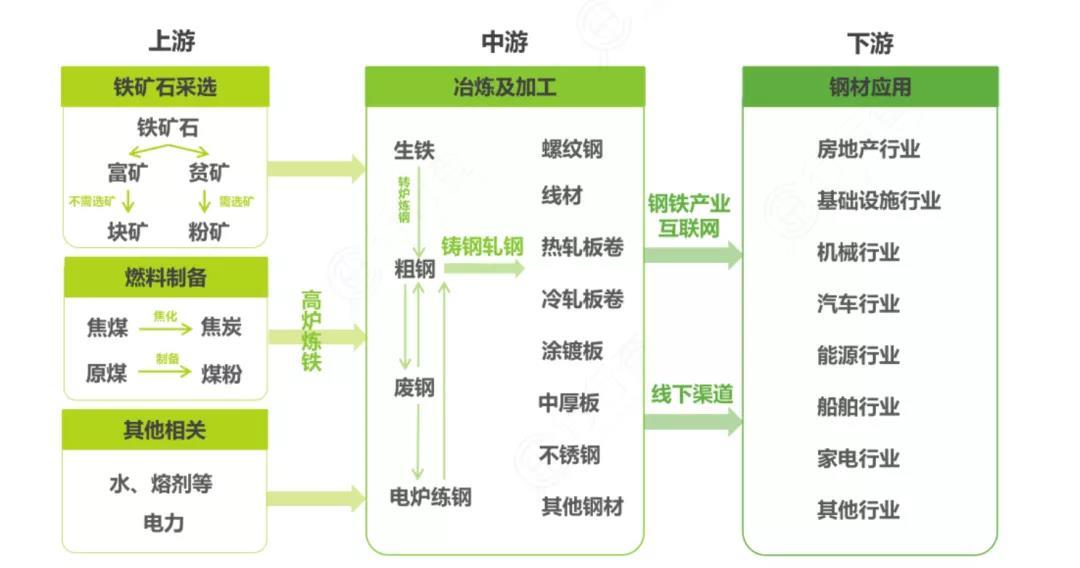

The global steel industry is about to enter a "buyer's market." Against the background of strengthening the strategic resource guarantee of iron ore and replacing imported ore with domestic ore, how to strengthen the green and collaborative development of upstream and downstream industries in the steel industry chain and build a whole industry chain is a problem that needs to be considered from a global perspective and planned for the long term.

According to China Metallurgical News, in 2022, China's pig iron and crude steel production are highly likely to be around 800 million tons and 920 million tons respectively (pig iron production is closer to 2019, and crude steel production is closer to 2018). Pig iron production will continue to decline by 62 million tons, and crude steel production will decline by 100 million tons, with a decrease of 7.2% and 10% respectively. The corresponding iron ore demand will decrease by about 100 million tons.

Carbon peaking and carbon neutrality are important constraints faced by China's entire steel industry in the near and medium to long term. Under the background of low-carbon and high-quality development, the current situation of high output and low efficiency in China's steel industry will lead to spontaneous production reduction and increased market supervision on ecological and environmental protection in the industry. If the downstream demand for steel weakens next year, China's crude steel production will most likely maintain the production reduction pace of the second half of this year.

Taking the development of Japan's steel industry as an example, after reaching its peak in 1973, Japan's crude steel production has generally adjusted in time according to changes in downstream steel demand, with year-on-year growth and decline rates between plus and minus 10%. China's crude steel production has most likely peaked in 2020, and future crude steel production will be adjusted timely and dynamically according to downstream steel demand to maintain reasonable profits in the steel industry and achieve the key goal of high-quality steel manufacturing.

In terms of iron ore, in addition to the high probability of a significant decline in demand, China's import ore port inventory 、

mining production rhythm and operating cash cost pressure are several key factors determining the bottoming out of iron ore prices next year.

Since June this year, with the decline in China's iron ore demand, the inventory of imported ore at ports has slowly rebounded and accelerated accumulation in October. According to Mysteel statistics, as of last Friday (December 10), the total inventory of iron ore at 45 ports in China was 154.8491 million tons, a week-on-week increase of 0.2798 million tons, and the average daily port throughput was 2.7972 million tons. Based on the current port inventory and port throughput level, the current inventory can be used for 55 days, an increase of nearly 57% compared to the level of only 34 to 35 days in the middle of this year.

According to Mysteel's survey, as of (December 10), the operating rate of blast furnaces in 247 steel mills was 68.14%, a week-on-week decrease of 1.66%, and a year-on-year decrease of 16.63%; the average daily pig iron production was 1.987 million tons, a week-on-week decrease of 18,100 tons, and a year-on-year decrease of 447,700 tons, and demand has not yet significantly improved.

On the supply side, the mining production rhythm is still running at a high speed. From the production and sales situation of major overseas mines, except for Vale in Brazil, which is gradually replenishing the production reduced in the 2019 dam collapse accident, the production of other mines remains at a high level.

Based on the current supply and demand fundamentals of iron ore, the supply and demand pattern of iron ore is still significantly loose. With the approach of the Winter Olympics and continued high-pressure environmental protection, the increase in pig iron production is limited, and the port inventory continues to accumulate. The market has clearly become fearful of the current ore price, and the iron ore price may maintain a wide range of fluctuations.

With the fluctuation of iron ore prices, there is also the issue of mining operating costs.

Currently, the C1 cash cost of iron ore for the four major mines is between $11.84 and $15.40 per ton. According to Mysteel data, the average production cost of iron concentrate in key domestic mines in 2020 was 367.54 yuan/ton (converted using the average exchange rate of 1 yuan = $0.1449 in 2020, which is equal to $54.54 per ton), almost four times the cost of the four major mines.

This year, affected by inflation, transportation, and ecological and environmental protection factors, China's raw ore production not only lacks market competitiveness but also bears significant operating and ecological and environmental protection pressure.

Domestic mines cannot break through on their own. It is necessary to speed up the integration of upstream and downstream resources and collaborative development through the reorganization of groups such as Baowu Group and Ansteel Group.

The global steel industry is about to enter a "buyer's market." Against the background of strengthening the strategic resource guarantee of iron ore and replacing imported ore with domestic products, how to strengthen the green and collaborative development of upstream and downstream industries in the steel industry chain and build a full industrial chain is an issue that requires a comprehensive and long-term plan.