Breaking News! A $7.005 billion copper mine, the largest overseas M&A in the history of China's metal mining industry, has been forced to shut down!

Recently, MMG (MMG) stated that its dialogue with the Chumbivilcas community in Peru failed to reach an agreement due to "excessive commercial demands." In November 2021, members of the Chumbivilcas community re-erected roadblocks, forcing Las Bambas to gradually shut down mine operations. Production will cease in mid-December due to a lack of key consumables.

Thus, the US$7.005 billion acquisition, the largest overseas copper mine acquisition in the history of China's metal mining industry, has been forced to a standstill.

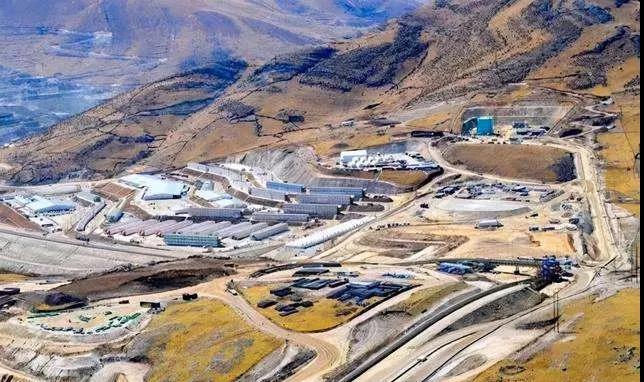

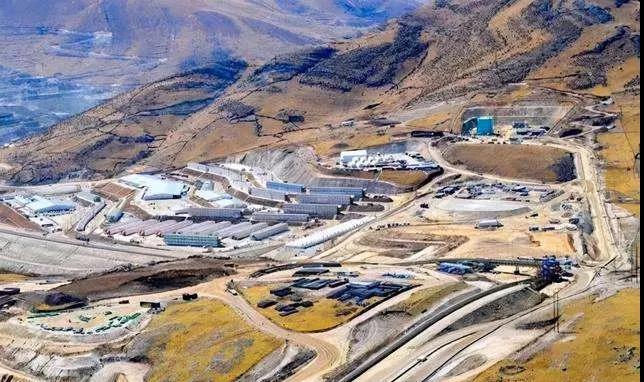

On July 31, 2014, a consortium led by MMG, a subsidiary of China Minmetals Corporation, officially acquired the Las Bambas super-large copper mine in Peru for US$7.005 billion, achieving the largest overseas M&A transaction in the history of China's metal mining industry at that time.

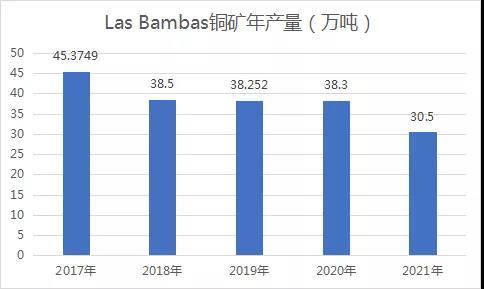

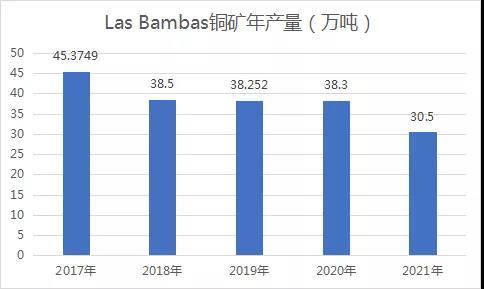

Las Bambas is the fourth largest copper mine in Peru and the ninth largest in the world. It began commercial production on July 1, 2016. In its first full year of operation in 2017, it produced 453,749 tons of copper, accounting for 76% of MMG's total output, helping MMG successfully enter the ranks of the world's top ten copper producers.

However, since its operation, MMG and the Las Bambas copper mine have been struggling to cope with intermittent protests and roadblocks. According to MMG, since its operation in 2016, the mine has been interrupted for nearly 400 days, leading to a continuous decline in copper production. In 2018, Las Bambas copper production fell by 15% year-on-year to 385,000 tons, 382,520 tons in 2019, and 383,000 tons in 2020, operating at low capacity for three consecutive years. 2021 production is expected to be at the low end of its 310,000-330,000 ton forecast.

Currently, the issue of contention between the two parties is the dirt road used by Las Bambas to transport copper from its mine to the port. The local indigenous community is unhappy because Las Bambas mine decided to transport copper concentrate by road instead of by pipeline as originally planned. Too many trucks pass through the road every day, disrupting the lives of nearby residents.

Communities along the route demand more logistics contracts, economic compensation for land used to build mining roads, and action to reduce the damage caused to their crops by the large number of trucks on the road every day. At the same time, the local community wants to establish a fund with 8% of the mine's annual profit to finance production and social development projects, while the company provides funding for individual social projects.

MMG believes that paving this route is the responsibility of the government, but the long-term solution is to build a separate freight train line. According to Peru's Ministry of Transport and Communications, the construction of this railway will take more than five years and cost US$9.2 billion.

In October 2020, in preparation for switching from oxide ore mining to sulfide ore mining, MMG's subsidiary in the Democratic Republic of Congo halted production at its Kinsevere mine, which was originally expected to last until the end of April 2021. However, according to the latest announcement, the Kinsevere mine's restart plan has been further delayed, and there is no hope of restarting this year.

As of the end of June this year, MMG's reserves of copper, zinc, molybdenum, silver, and gold have all declined, especially copper resources, with a 6% decrease in resources and a 5% decrease in copper ore reserves. In the past two years, MMG's copper sector has experienced a turbulent period, facing severe challenges.

As an important raw material for basic industries, copper is an indispensable functional material for China's construction of a manufacturing powerhouse. Ensuring a stable supply of copper raw materials is a necessary part of China's resource security strategy.

In recent years, a large number of enterprises, including Zijin Mining, China Minmetals, Chalco, Luoyang Molybdenum, Huayou Cobalt, and Tongling Nonferrous Metals, have successively gone abroad. According to publicly available media reports, the amount of copper resources and copper production capacity controlled by Chinese companies overseas is almost equal to that in China, providing important guarantees for ensuring the basic resource security of China's new era and high-quality development.

However, due to the complexity and high risk of overseas mineral resource investment, some projects are not yet ready for construction and production due to various reasons, and have been in a state of rights protection or slow progress for a long time. Some projects have been abandoned due to low development value. High-value mines, such as Las Bambas, also face many "obstacles."

The globalization of China's copper industry still has a long way to go.

Recently, MMG (MMG) stated that its dialogue with the Chumbivilcas community in Peru failed to reach an agreement due to "excessive commercial demands." In November 2021, members of the Chumbivilcas community re-erected roadblocks, forcing Las Bambas to gradually shut down mine operations. Due to a lack of key consumables, production will cease in mid-December.

Thus, $7.005 billion acquisition, the largest overseas merger and acquisition in the history of China's metal mining industry the copper mine has been forced to shut down.

On July 31, 2014, a consortium led by MMG, a subsidiary of China Minmetals Corporation, officially acquired the Las Bambas super-large copper mine in Peru for $7.005 billion, achieving the largest overseas merger and acquisition in the history of China's metal mining industry at that time.

Las Bambas is the fourth largest copper mine in Peru and the ninth largest in the world. It began commercial production on July 1, 2016. In its first full year of operation in 2017, it produced 453,749 tons of copper, accounting for 76% of MMG's total output, helping MMG successfully enter the ranks of the world's top ten copper producers.

However, since its operation, MMG and the Las Bambas copper mine have been struggling to cope with intermittent protests and roadblocks. According to MMG, since its operation in 2016, the mine has been interrupted for nearly 400 days, leading to a continuous decline in copper production. In 2018, Las Bambas copper production decreased by 15% year-on-year to 385,000 tons, 382,520 tons in 2019, and 383,000 tons in 2020, operating at low capacity for three consecutive years. 2021 production is expected to be at the low end of its 310,000-330,000 ton forecast.

Currently, the issue in dispute is the dirt road that Las Bambas uses to transport copper from its mine to the port. Because Las Bambas mine decided to transport copper concentrate by road instead of by pipeline as originally planned, causing dissatisfaction among the local indigenous communities. Too many trucks cross the road every day, disrupting the lives of nearby residents.

Communities along the route demand more logistics contracts economic compensation for land used to build mining roads, and action to reduce the damage caused to their crops by the large number of trucks on the road every day. At the same time, the local community wants to use 8% of the mine's annual profit

to set up a fund to finance production and social development projects ,

while the company provides funding for individual social projects. 。

MMG believes that paving this route is the responsibility of the government, but the long-term solution is to build a separate freight train line. According to the Peruvian Ministry of Transport and Communications, the construction of this railway will take more than five years and cost $9.2 billion. 。

In October 2020, in preparation for the transition from oxide ore mining to sulfide ore mining, MMG's subsidiary in the Democratic Republic of Congo halted production at its Kinsevere mine, which was originally expected to last until the end of April 2021. However, according to the latest announcement, the Kinsevere mine's resumption of production plan has been further delayed, and there is no hope of resuming production this year.

As of the end of June this year, MMG's reserves of copper, zinc, molybdenum, silver, and gold have all declined, especially copper resources, with a 6% decrease in resources and a 5% decrease in copper ore reserves. In the past two years, MMG's copper sector has experienced a "turbulent period" and faces severe challenges.

As an important basic industrial raw material, copper is an indispensable functional material for China's construction of a strong manufacturing industry. Ensuring a stable supply of copper raw materials is a necessary part of China's resource security strategy.

In recent years, a large number of enterprises, including Zijin Mining, China Minmetals, Chalco, Luoyang Molybdenum, Huayou Cobalt, and Tongling Nonferrous Metals, have successively gone abroad. According to publicly available media reports, the amount of copper resources controlled by Chinese companies overseas and the copper production capacity of overseas mines are almost equal to those in China, providing important guarantees for ensuring the basic resource security of China's new era and high-quality development.

However, due to the complexity and high risk of overseas mineral resource investment, some projects are not yet ready for construction and production due to various reasons, and have been in a state of rights protection or slow progress for a long time. Some projects have low development value and can only choose to withdraw. High-value mines, such as Las Bambas, also face many "obstacles".

The globalization of China's copper industry still has a long way to go.